Virtual CFOs (VCFO services) are coming to realise an elevated, growing emphasis on personal effectiveness as they assume increased enterprise responsibilities within a disrupted landscape of emerging technologies and an increasingly challenging talent market.

Improving the effectiveness of resource allocation and optimizing costs are two classic tasks that CFOs still believe to be critical factors in success, but the way they approach these is changing. CFOs increasingly analyze cost and investment decisions in an enterprise-first light of profitable growth and digital transition.

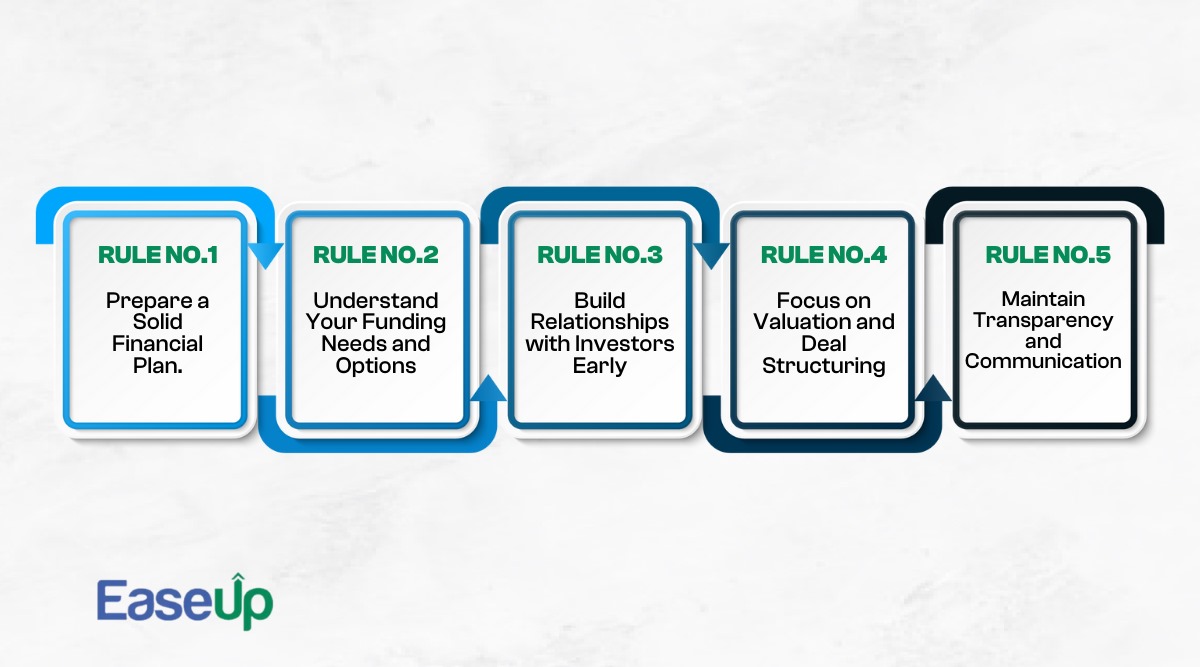

Rule 1: Prepare a Solid Financial Plan

Research the investor, the fund, and the team you plan to meet. Question your investment banker. Not only that, conduct independent research of the Investor reading on the internet or ask people in your networking circle. You can also consider listening to recorded calls of Analysts/Investors of other companies, in which the investor already invested. All this will help you prepare and strategize in preparation for the meeting.

Of course, developing financial projections isn’t exactly an easy thing to do; however, this is an extremely critical aspect of developing a well-thought business plan to guide your organization into the future knowing that you are sure to have the necessary cash flow to get there.

As your business grows, it will require more cash to generate and support other revenue streams. Financial projections will help assess what additional assets are required to support higher revenues and the associated impact on your balance sheet. The financial plan that you will create from these projections will also tell you how much additional debt or equity you will need so that you remain solvent and healthy.

If your business is over one year old, creditors will not only ask for historical data based on your company’s past performance but also request financial projections. In most cases, creditors want financial data and projections that are three to five years before and after the date you want your money. This financial modelling will help them understand what your future may look like.

Preparing the financial projections involves making a forecast of the income statement, balance sheet, and cash flow statement. All projections are prepared month by month for the first year and then by year in the following two years.

Rule 2: Understand Your Funding Needs and Options

A virtual CFO, also known as VCFO or fractional CFO, is a consultant or firm that may offer VCFO services to one or more businesses on a part-time or as-needed basis. Conventionally, however, a real CFO was a very highly paid employee of large corporations only. But with the present unstable economy, the expertise and service of a CFO have been in the greatest demand by smaller enterprises and even startup companies. And so, there come the new VCFO services.

Since the position is flexible, the cost depends on the time and responsibility that goes with it. Whichever way, however, the cost would be much lower compared to having a full-time CFO. In fact, for an expert virtual CFO, one can expect between $3,000 to $10,000 per month, and most retainers are positioned between $5,000 to $7,500.

It would depend on your needs and the complexity of your business and may even be lower if you have a good solid financial team that can handle controller, bookkeeping, or accountants, in complementing the virtual CFO role.

To understand how much VCFO services will cost, it would be best to discuss first what a virtual CFO is and the functions that could be involved in this role. It helps, too, to understand how a virtual CFO compares with a bookkeeper, an accountant, a controller, or even a full-time chief financial officer. The words “virtual” and “CFO” are very important here. Let’s explore these roles and terms.

Rule 3: Build Relationships with Investors Early

Investors want to hear about company financials, compliances and related matters only from the CFO. And hear business, primarily from the CEO. In fact, some investors even insist on CFOs being a part of the fundraising team of the Company.

So you should first form the right team that should be participating in roadshow presentations (you may want to decide to have one or two senior executives, who are integral to the business, in addition to the CEO & virtual CFO as part of the core fundraising team.

Do not forget that more than 3 is not advisable). Thus, take some time and predetermine what questions/subjects of questions will be answered by which member of the team.

Rule 4: Focus on Valuation and Deal Structuring

Using investment appraisal techniques and financial leverage ratios helps us analyze how suitable the optimal debt-equity mix is for your business. This can help the company find the required funds at favourable terms and maintain its capital structure healthy while enhancing its financial stability and growth prospects in the business.

VCFO services offer performance measurement through key performance indicators and balanced scorecard methods. These techniques not only provide you with a holistic view of your business performance but also focus on the areas that need improvement. They further guide you in target setting, thus increasing the efficiency, productivity, and profitability of your business operations.

One of the key features of VCFO services is the ability to integrate your financial systems with your other business software. In this manner, all aspects of the workflow can become streamlined and efficient, improving the accessibility of data among different departments and coordinating more effective business operations with timely insights of information to support better decision-making.

Rule 5: Maintain Transparency and Communication

The basis for such an achievement by CEOs is that open and honest communication forms the basis of a strong partnership between the CEO and virtual CFO by bringing about trust, respect, and harmonized goals between the two.

CEOs must be in open communication with their CFOs about any issues of finance that concern the welfare of the organization, involved risks, and strategic opportunities. This will ensure that the whole team stays aligned with the critical decisions made by management.

Discuss financial reports, market trends, and organizational initiatives regularly in one-on-one meetings. Don’t just look at the numbers. Ask your CFO what story the data tells and what actionable insights they see within their reports.

The Role of a Virtual CFO in the Fundraising Process

VCFO services can help a business by fundraising in a variety of ways, such as:

Creating a financial story: A VCFO can create a financial story for a business to help with fundraising.

Light pitching: A VCFO can do some light pitching for a business.

Helping with informed decisions: VCFO services can help a business make informed decisions about raising and hence have a better capital structure and investment opportunities.

Conclusion: Master the Fundraising Process with EaseUp’s VCFO Services

On a fundraising roadshow, you have to stay faster and make sure that you meet as many investors as possible. To get firm commitments from them, you are required to follow up aggressively post your meeting with the investor. If you take more time, you might lose the excitement and the interest you would have generated through your meeting.

Worse still, you never know what stage it might be at when some other uncontrollable factor comes along to create negative sentiments, thus hampering the efforts you would have put into this entire process.

Found this blog useful? Contact EaseUp VCFOs now to get started with modern financial management!