Virtual CFOs help startups manage their cash flow effectively so that they have enough capital to meet costs and invest in growth. Key aspects of cash flow management include Forecasts and monitoring cash flow. CFOs prepare cash flow forecasts to predict cash inflows and outflows in the future.

These are essential in startups’ fund management, enabling them to make good decisions and generate growth. A startup that understands these services will be able to prioritize its financial needs and ensure it has all the right support.

A fractional CFO’s operation is quite different for different startups or companies that they may be serving, as their services can be provided virtually, which is great for those businesses that are remote or have locations around the world. Others may prefer on-site work, closely working with the company team to better service them.

EaseUp’s virtual CFO services in India are primarily meant to make it easier for you to handle your finances, which in turn means making the operations of the company efficient, along with helping you focus on growth initiatives. You will be given detailed financial advice that specifically caters to your needs, making you utilize your time more wisely in developing it.

What is a Virtual CFO?

This means if your annual revenue is below $2 million, you’re probably best off staying with a bookkeeper or a traditional CPA firm as it is less expensive.

When you cross that $2 million revenue mark and you need financial guidance but cannot quite afford a full-time CFO or controller, you may want to consider VCFO services. They offer ski skills that are required but at a less expensive full-time cost, empowering you to steer your financial development with confidence.

Virtual CFO services in India can oversee all finance from budgeting to financial planning and even strategic financial decisions. He/She can give you a real budget. This would mean that you would know how much you and your team have to spend and how much you could be making. A virtual CFO can collect and track such information that will lead you in the right direction. For example, either quarterly or yearly reports will help you understand what area you might be underperforming or overspending on.

What is a Fractional CFO?

Fractional CFO services comprise financial experts essentially offering their broad expertise on a contractual basis to an emerging startup. In other words, if the start-up is battling through various complexities of finance management, a fractional CFO could well be a godsend who can help out with tasks such as planning and controlling the finances or budgeting for it.

Their role also lies in strategy planning, such as directing companies through mergers or acquisitions or even helping launch an IPO.

Based on a very basic perspective, fractional CFO services are assumed to oversee the financial activity of a company, very much like a traditional CFO. However, the sole difference here is that it is carried out part-time and the fractional CFO would be serving multiple clients concurrently.

The key responsibilities in their job consist of cash flow management, financial planning, budgeting, risk management, and data analysis. They mainly contribute to major financial decisions with strategic critical insights into business growth.

These CFOs are appointed when a startup can’t afford a regular-time CFO but still needs expertise. A fractional CFO may be hired as a cost-effective alternative when desired financial and strategic acumen is assured without committing to full-time.

Key Differences Between Virtual CFO and Fractional CFO

The difference between the two roles, VCFO services and fractional CFO, is that a Virtual CFO brings high-level financial acumen directly to your business but with a modern twist. A Virtual CFO doesn’t come into your office to sit at the desk but operates virtually.

A virtual CFO is often more advisory and strategic. They can be quite hands-on.

Thus, if you are just starting and require only strategic guidance to establish financial systems, a virtual CFO is sufficient. If you require more hands-on management as well as operational support, a fractional CFO would be better.

Pros and Cons of Virtual CFO Services

Benefits of Virtual CFO Services

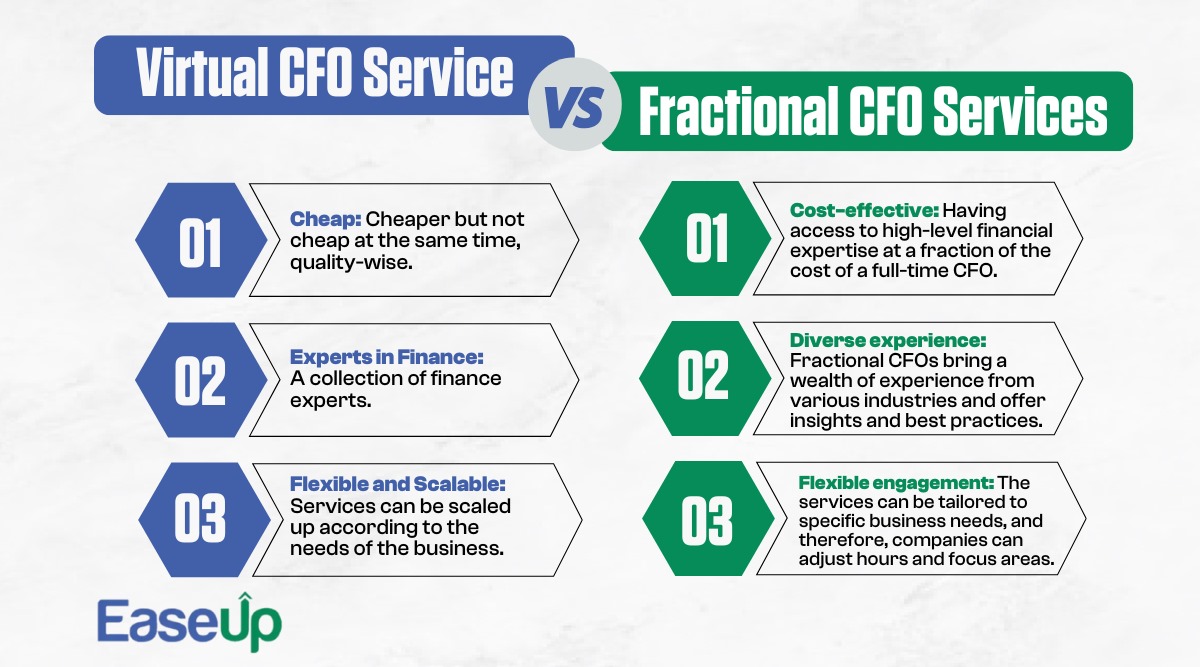

- Cheap: Cheaper but not cheap at the same time, quality-wise.

- Experts in Finance: A collection of finance experts.

- Flexible and Scalable: Services can be scaled up according to the needs of the business.

Drawbacks of VCFO Services in India

- Less Face-to-Face: Primarily work-based online.

- Cultural Fit: They may not fit in well with the company culture.

- Less Control: You will have less control over the financial team.

Pros and Cons of Fractional CFO Services

Benefits of Fractional CFO Services

- Cost-effective: Having access to high-level financial expertise at a fraction of the cost of a full-time CFO.

- Diverse experience: Fractional CFOs bring a wealth of experience from various industries and offer insights and best practices.

- Flexible engagement: The services can be tailored to specific business needs, and therefore, companies can adjust hours and focus areas.

- Focus on Strategy: They help business owners focus more on growth and operations. All the complicated financial issues are taken care of by the service.

Disadvantages of Fractional CFO Services

- Not Available During the Crisis: They will not be available when you have to make urgent financial decisions. This would increase the chances of delay.

- Low Integration: The fractional CFO would not understand the specifics of the financial landscape or operations of the company that well.

- Misalignment Probability: Their approach may not perfectly align with the vision or long-term goals of the company.

- Dependency on Advisory Services of an External Chief Financial Officer: The core team and its members would lack requisite internal financial experts as well as adequate knowledge transfers at the working level because of it.

How to Choose the Right CFO Model for Your Business

The following factors need to be considered in the selection of the right CFO model for your business:

- The present business situation is one of rapid growth, fundraising focus, and complicated operations.

- Virtual CFO services in India for rapid growth must have multidisciplinary experience.

- Hire a CFO in advance with a good track record in fundraising.

- For businesses with intricate operations, hire an industry-specific CFO.

- Cost efficiency, value-add, and risk management must be balanced when designing the finance and reporting operating model.

Conclusion

With time, as a startup becomes more complex, it will require virtual CFO services in India to manage operations and finances and make strategic decisions effectively. VCFO services or a fractional CFO might not be necessary during the initial days of starting a startup (unless private investors fund your business).

Well, one needs to choose between whether it is a virtual CFO for strategic remote support or hands-on financial management to manage the growth of the startup in full.

If you want to know about these on a free consultation call with EaseUp or are interested in our services, click here.