The Technology Company, Startup and Small & Medium Business sectors are fighting through the competition that emerged from new players and products as a result of liberalization in the economy of India. For example, in the present dynamic business environment, a company should always require the need for virtual CFO services to ensure profitable continuance and extend business.

A virtual CFO advises businesses to make effective financial decisions, enhancing profitability, and attaining more stable long-term financial goals, usually through work outsourcing and the use of online tools that enable collaboration without geographical bounds.

What is a Virtual CFO?

A VCFO brings professional financial management and consultative services at the same level as a full-time executive but costs much less.

It involves understanding the firms’ objective and strategic position in the market. The best virtual CFO services ensure that firms are financially sound and ready for massive expansion. VCFOs understand the current financial situation of the organization regarding the industry, rivals, and areas for growth.

All the services a regular CFO would offer are provided by a VCFO, but only when asked for by the organization. Virtual CFO services can do everything an in-house CFO can do; however, you get only what you ask for and much less responsibility will be taken care of.

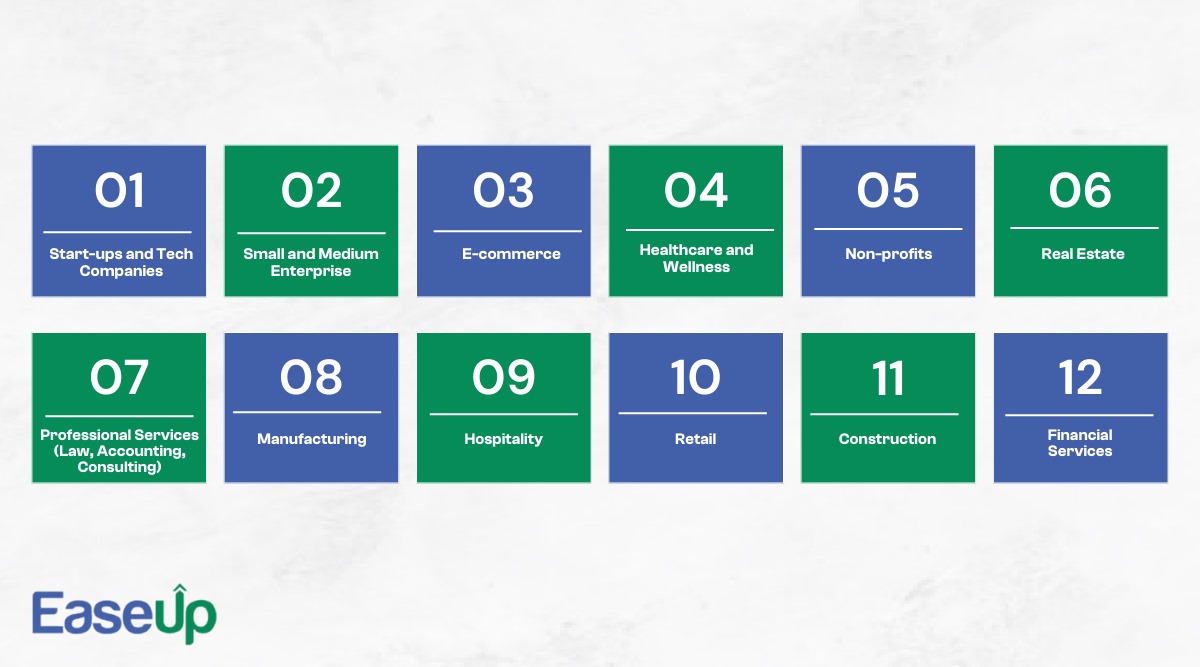

Industries That Benefit Most from Virtual CFO Services

Start-ups and Tech Companies:

Start-ups in the tech sector especially require financial planning and analysis without the cost of a full-time CFO. They hire a virtual CFO to aid them in raising funds, scaling up, and managing fast growth.

Small and Medium Enterprises:

For all the sectors, SMEs, most often need strategic financial advice that cannot be afforded as a full-time CFO. VCFOs support cash flow management and budgeting, as well as financial strategy.

E-commerce:

High transaction volume and the imperative requirement of inventory management demand that e-commerce companies rely on virtual CFO services for financial forecasting, cost control, and profitability analysis.

Healthcare and Wellness:

Medical practices, clinics, and wellness centres require sophisticated billing systems and more regulatory compliance that they demand. Virtual CFO services support cash flow management, patient billing, and reporting financials.

Non-profits:

Non-profit organizations must carefully spend their resources to maximize impact. VCFOs support donor management, grant compliance, and budgeting.

Real Estate:

Virtual CFO services are great for the finance function in real estate firms, property developers, and investment companies, particularly for project financing, risk assessment, and management of cash inflows from sales or rentals.

Professional Services (Law, Accounting, Consulting):

Professional services companies rely on VCFOs to manage their billing cycles, client profitability, and financial reporting.

Manufacturing:

Manufacturing companies require CFOs to stage cost controls, supply chain financing, and plans for capital expense. Virtual CFOs facilitate their standardization.

Hospitality:

The nature of hotels, restaurants, and tourism businesses is such that they have non-recurrent revenues and complex structures of costs. VCFOs help in optimizing revenue management and budgeting.

Retail:

All retail businesses physical or online reliant on virtual CFO services for managing inventories, cost controls, and profit margin analyses.

Construction:

Construction firms use virtual CFOs to handle project-based financial management, cost tracking, and long-term capital planning.

Financial Services:

Small fintech companies and fintech startups, insurance companies, all require virtual CFOs to ensure regulatory compliance, manage cash flow, and formulate investments.

Key Benefits of Virtual CFO Services for Various Industries

Best virtual CFO services provide businesses with high strategic financial direction without the cost of a full-time executive. Here are ten benefits-

VCFOs are flexible in terms of engagement. Whether you need strategic advice or financial management, you can adapt the level of service for any need of your business.

-

Expertise on Demand

Virtual CFOs bring years of experience to the table and expertise. Seasoned financial experts with a proven track record in multiple sectors, VCFOs can provide useful insights and guidance.

-

Strategic Financial Planning

Virtual CFOs assist in developing and executing strategic financial strategies that align with business goals. They analyze different types of financial information, highlight areas of growth, and suggest lines that best optimize profitability and sustainability.

Furthermore, businesses facing financial difficulties resulting in dwindling profits or low cash flow levels or failing to stay compliant with regulatory compliance can avail the best virtual or fractional CFO services to regain their financial trajectory.

-

Cash Flow Management

So, managing the cash flow is quite crucial in terms of business success. Best Virtual CFO Services help optimize cash flow through inflow and outflow oversight, cash requirement forecasting, and effective cash management.

-

Financial Analysis and Reporting

The VCFO delivers detailed financial analysis and reporting required for decision-making. They determine the right financial reports, review key performance indicators, and analyze the overall financial data that gives the direction of direction and the areas for improvement.

-

Risk Management

Virtual CFOs help you identify the financial risks that may strike your business and facilitate actions to minimize such risks. They analyze possible risks, craft strategies to help control and mitigate such risks, and put in place controls to protect your assets and reputation.

-

Business Performance Optimization

Virtual CFO services assist you and other key business persons in the optimization of performance. They evaluate financial positions, scrutinize your business processes, and suggest changes to optimize effectiveness and productivity while maximizing profitability.

-

Support for Mergers and Acquisitions

Virtual CFOs help a lot of work through merging and onboarding as well as business altering. They conduct a thorough and fair financial review, check the impact of the transaction on the financial statement, and provide strategic recommendations for smoother money flow.

-

Scalability

The best online CFO services are scalable, meaning as your business evolves, the VCFO can adjust too. Be it talent acquisition or managing tough market conditions, they are pros at it.

When Should You Consider Hiring a Virtual CFO?

A Virtual CFO also provides anti-loss recommendations on the basics of financials involved in growth. A Virtual CFO‘s experience ensures the alignment of your business goals with fundraising and growth efforts.

Absence of In-House Financial Expertise and Strategic Financial Planning

Many SMEs and startups lack a full-time, in-house financial expert.

Such an experience gap will creep into non-strategic longer-term growth and risk management, causing non-strategic businesses and misguided moves. A Virtual CFO can help interfere with and develop forward-thinking financial management plans to help you stay focused on your long-term goals.

As businesses grow, expenditures can go out of control, often unnoticed until they negatively impact gains. Recognizing ineffectiveness and areas where expenses can be reduced requires detailed financial inspection. A VCFO can conduct an in-depth inspection of operational costs, vendor contracts, and resource allocations to find opportunities for savings and reinvestment into growth areas.

Desire to Improve Financial Performance

Businesses looking forward to expanding profitability and revenue need more than just simple accounting. Also, they need expert financial master plans to work out undiscovered dividend-generating opportunities.

Advanced financial game plans implemented by a VCFO offer considerably more than basic account management, assessing financial data, market trends, and business performance to recognize areas for growth while being answerable in ensuring that the business is on the right path toward increasing profits.

How EaseUp Can Help With Virtual CFO Services

EaseUp’s Virtual CFO services help companies achieve maximal revenues with fewer expenses, minimise business risks, and improve the monetary health of businesses.

EaseUp offers Profit Improvement, Business Improvement & Transformation, Succession Planning, Corporate Structuring, and all such financial strategies that are essential to the smooth running of your enterprise.

With EaseUp Virtual CFO Services, You Get the Benefit of:

- Strategic financial direction

- Cost-effective CFO competence

- Enhanced growth opportunities

- Proactive planning and analysis

- Successful Risk Management

- Rapid, well-informed decisions

- Simplified regulatory compliance

- Ongoing access to learning

Conclusion:

Virtual CFO services are the backbone of modern financial management. Thus, they are much needed by all businesses today, be it small or large. Through such services, firms can help organizations make the proper decisions, improve their money flows, and eventually reach the desired growth strategies.

Such is the case of virtual CFO services, whereby professional help is of great convenience in facilitating financial processes and, hence, quicker achievement of set targets. As such, the EaseUP strategy is bound to ensure that companies do not only run their businesses to avoid failures but rather excellently outshine the prevailing competition.

Connect with EaseUP today and let our virtual CFO services help digitize the way you manage your finances. Visit our website or call for a consultation to find out more about our bespoke financial solutions and how we provide the very best in virtual CFO services to help support your business success.